A corporate bond is like a loan from an investor to a company, which the company repays with interest by the bond’s maturity date.

Businesses consider bonds to be an attractive way to raise funds for their operations or capital expenditures because the interest they must pay to investors is less than what they would owe to a bank through a loan. And unlike selling stock, a company is not giving away ownership rights when it issues bonds.

There are many types of corporate bonds, although most are issued with maturities between 1 and 30 years. Bondholders usually receive regular payments of interest, known as the coupon, which is determined upon the bond’s issuance. Corporate bonds are subject to taxes at the state and federal levels in addition to capital gains taxes.

How Are Corporate Bonds Classified?

Corporate bonds are classified by maturity. They are usually grouped into three categories:

- Short-term, which have maturities of less than three years;

- Medium-term, which are maturities between four and 10 years; and

- Long-term, which mature in more than 10 years. Longer-term bonds usually have higher coupons than short-term bonds, but they also come with increased risks.

How Are Corporate Bonds Rated?

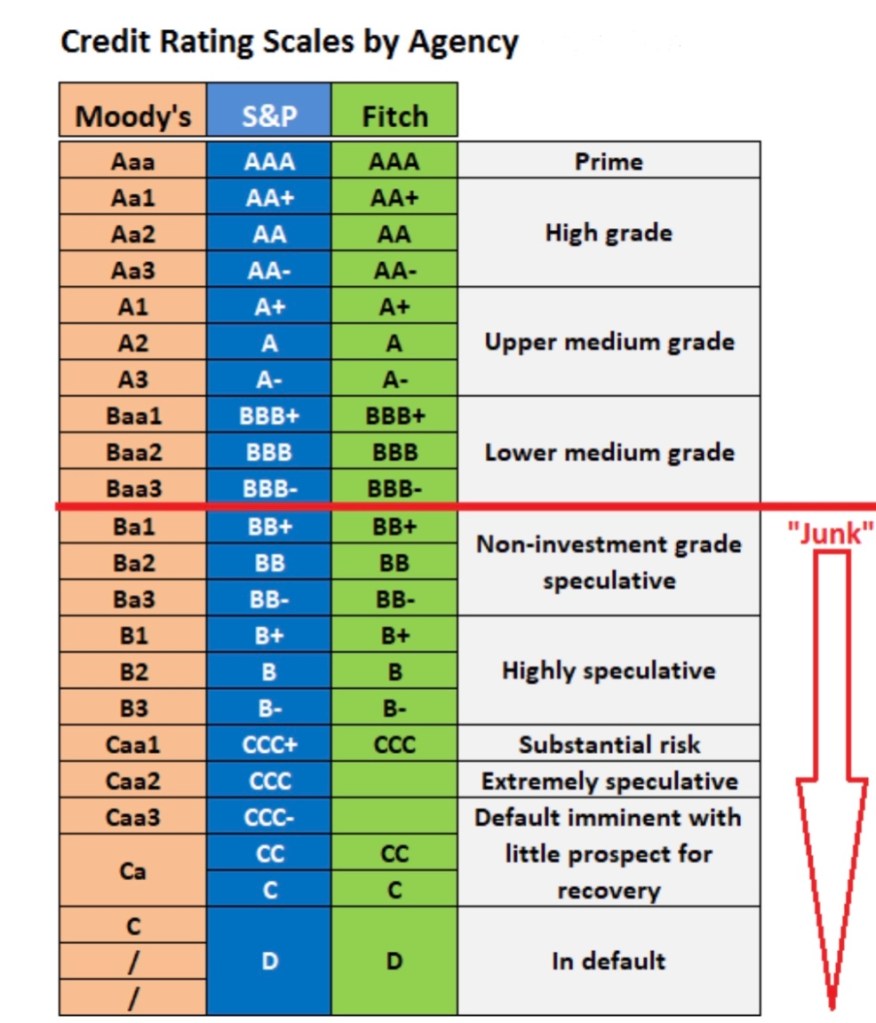

Ratings agencies, such as Moody’s, Standard & Poor’s, and Fitch Ratings assess bonds based on their creditworthiness, which means their ability to make payments in a timely manner. They assign bond ratings to corporate bonds, which range from AAA (the highest) to D (the lowest).

Bonds that are rated B and above are consideredinvestment-grade. Bonds that are rated below BB are known as junk bonds. This chart illustrates different bond ratings.

To compensate investors for the increased risk, non-investment-grade bonds usually offer higher coupons than investment-grade bonds. These bonds are also known as high-yield bonds. Just remember, the higher the yield, the higher the risk of default, and in the event that a company declares bankruptcy, its investors may not get all of their money back.

Are Corporate Bonds Guaranteed?

Corporate bonds are considered to have greater risk than government bonds because corporate bonds are guaranteed only by the companies who issue them. That means that if a company declares bankruptcy and defaults on its bonds, bondholders will have some claim on the company’s assets.

The order in which investors receive these assets are structured in the following ways:

- If an investor purchased a secured bond, the company had used its assets, such as property and equipment, as collateral. These bondholders are legally entitled to these assets.

- Unsecured bonds, on the other hand, do not have collateral attached to them, although investors in this type of bond are entitled to the company’s general cash flows. Unsecured bonds are also known as debentures and ranked in priority from senior to junior, and investors receive collateral in that order.