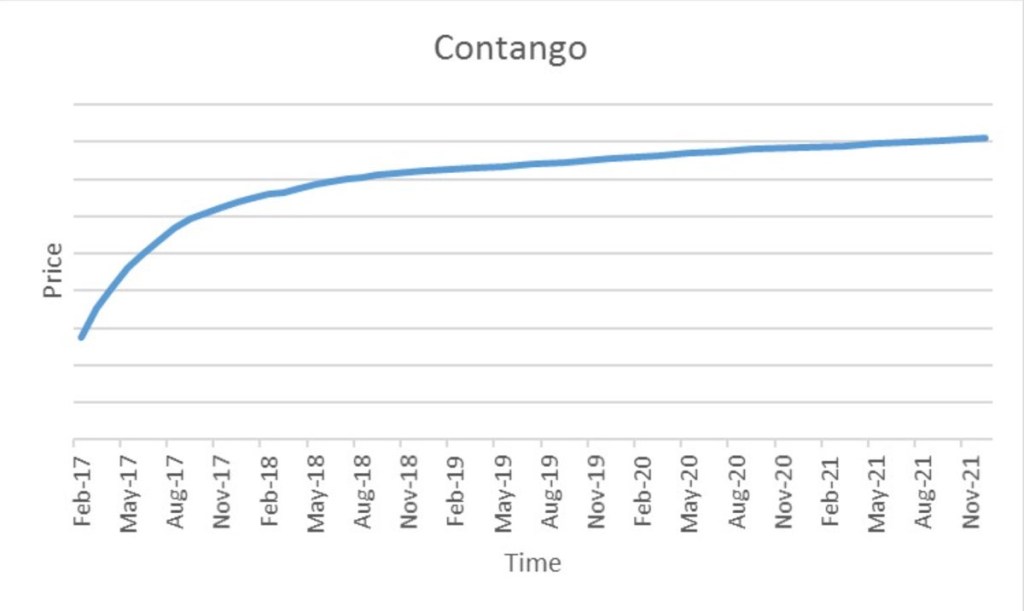

When a market is in contango, the forward price of a futures contract is higher than the spot price. In the chart below, the spot price is lower than the futures price which has generated an upward sloping forward curve. This market is in contango – the futures contracts are trading at a premium to the spot price. Physically delivered futures contracts may be in a contango because of fundamental factors like storage, financing (cost to carry) and insurance costs. The futures prices can change over time as market participants change their views of the future expected spot price; so the forward curve changes and may move from contango to backwardation.